Shanice Lodge

In commercial real estate (CRE), maximizing your returns will come down to how well you optimize your tax strategy. The U.S. tax system is replete with opportunities to capitalize on these benefits. Let’s cover some of the most advantageous tax strategies you can implement in your real estate journey.

What is depreciation in CRE?

Depreciation allows investors to deduct the wear and tear of a building over time, reducing taxable income. Commercial buildings can typically be depreciated over 39 years through standard depreciation.

What is accelerated cost recovery (ACRS) in CRE?

A cost segregation study reclassifies certain features of the building (lighting, fixtures, HVAC) into shorter recovery periods (5, 7, or 15 years) instead of 39 years, thereby accelerating the recovery period and providing a large upfront tax benefit.

According to Investopedia, “ACRS was implemented in 1981 by the Internal Revenue Service (IRS) and replaced in 1986 by the modified accelerated cost recovery system (MACRS).” The goal and result of ACRS was that it left companies with more revenue in their pockets.

What is bonus depreciation?

Bonus depreciation allows you to deduct a percentage of a qualified asset in the year it is placed in service. This strategy reduces income tax, and therefore it’s tax liability. Qualifying asset requirements can be found here: Additional First Year Depreciation Deduction

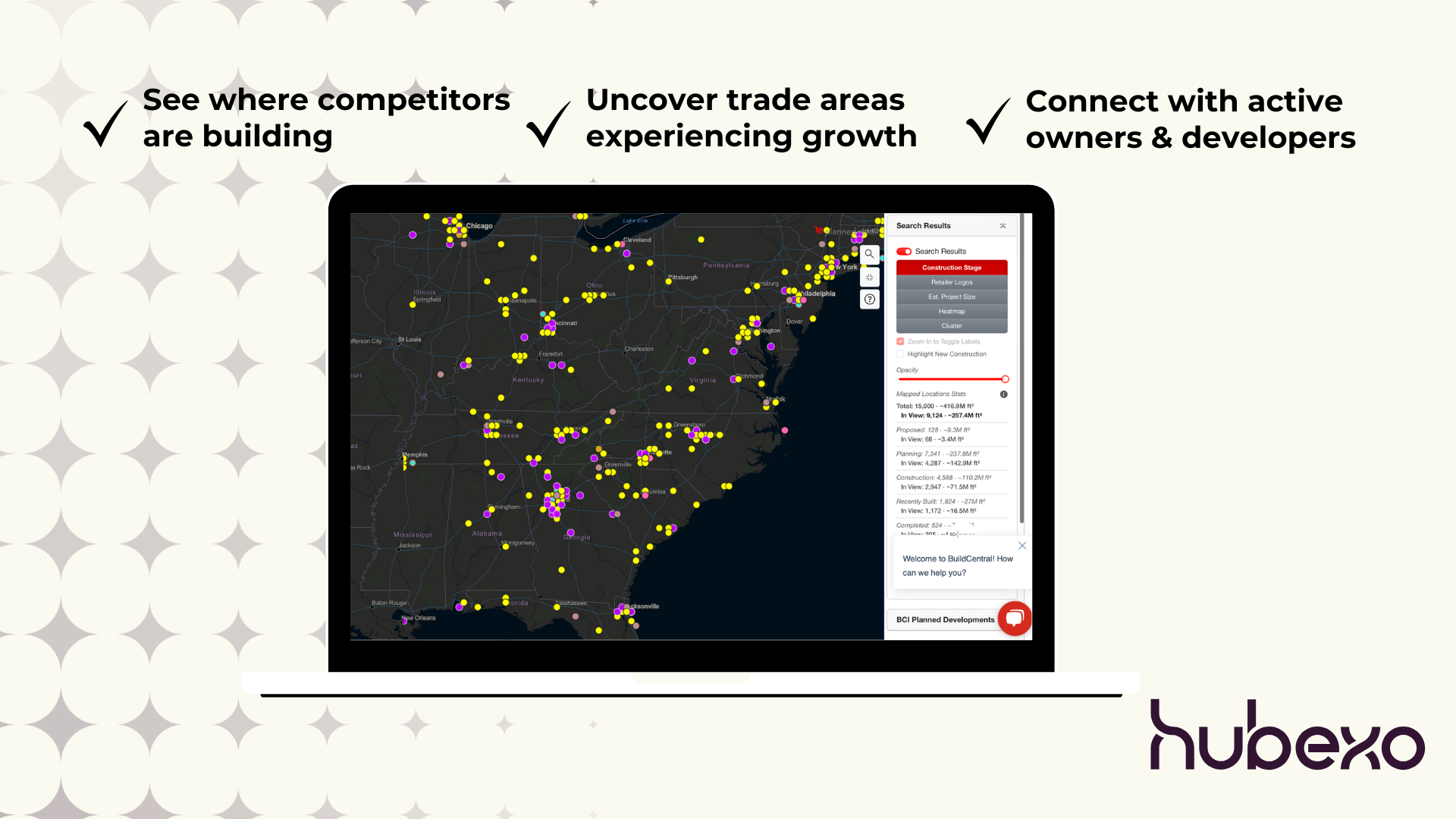

Ready to find projects for your next cost segregation opportunity? Hubexo tracks who is building what, where, and when. See who is coming into the market today.

What is the 1031 Exchange?

The 1031 exchange (like-kind exchange) allows investors to defer paying taxes when they sell an investment property, then reinvest the proceeds into a similar property within specific time frames and guidelines. There are strict timelines, for instance, “You have 45 days from the sale of the original property to identify replacement properties and 180 days to complete the purchase. These deadlines are rigid and cannot be extended.” This is a complex strategy, so getting help from a professional is recommended.

What are Opportunity Zones (OZs) in CRE?

Opportunity Zones were created under the Tax Cuts and Jobs Act of 2017. These are distressed areas where investment can receive significant tax incentives. When investors reinvest capital gains into a Qualified Opportunity Fund (QOF), they can temporarily defer capital gains taxes from the original investment until a specific date or potentially exclude all capital gains on the OZ investment itself if held for 10 years or more.

What is the Section 179D Energy-Efficient Commercial Buildings Deduction?

Section 179D rewards owners and designers of energy-efficient commercial properties. As of 2025, when you install qualifying systems that reduce a building’s total annual energy and power costs, owners/designers can save between $2.90 to $5.81/sf.

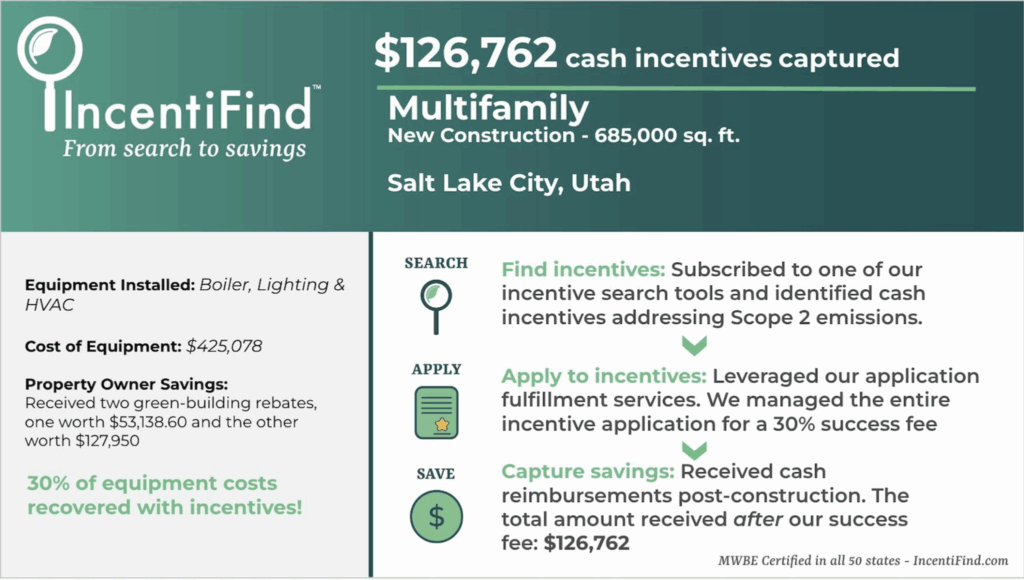

This multifamily property in Salt Lake City, Utah, capitalized on $126,762 in post-construction cash incentives, and you can too!

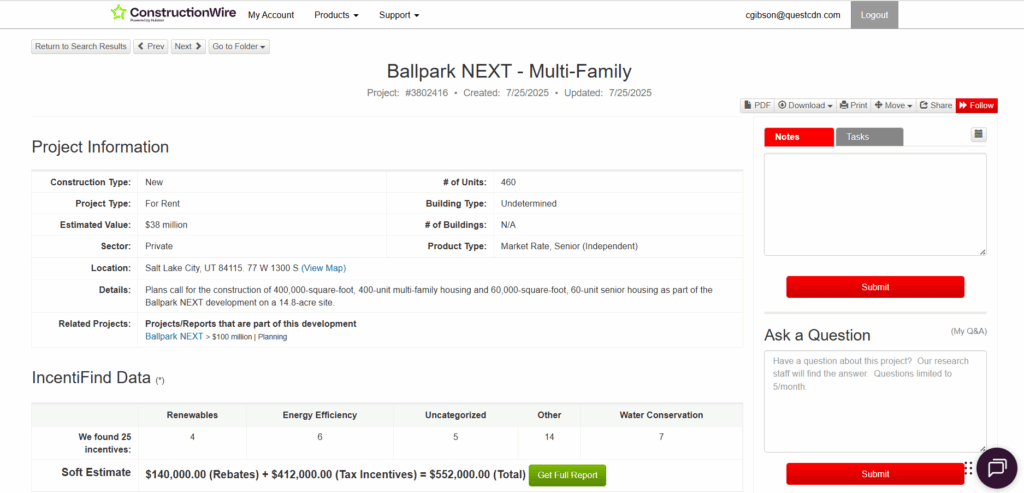

In partnering with IncentiFind, ConstructionWire will help you find cash-saving incentives in one place. Simply find a project you’re interested in on our platform, and see the associated incentives right on the project report, as you can see below. In just a few clicks, you can apply for incentives to put money in your pocket.

How to find your next CRE tax advantage

We’ve provided you with the tax advantages, but they are only helpful to you if you know where the right projects are. Hubexo is the hub of the construction industry, providing you with industry-leading construction insights. From pre-permit to post-construction, we are here to guide you every step of the way. Book a free demo and start generating highly targeted leads today.

Related

Missing Out on Incentives? This Hotel Was—Until It Found $42K

How Building Incentive Data Scored a Warehouse $150,000

How an Industrial Building Found $200K in Incentives

A New Multifamily Development Found $200K in Building Incentives and You Can Too

Building Green, Earning Green: How Sustainable Construction Pays Off

There’s a Childcare Desert Problem in Rural America and Developers Have the Solution

What Does Building Green Mean in Construction, and How Can It Save You Money?