Chris Gibson

In the fast-evolving healthcare landscape, software companies play a vital role in powering everything from patient records to diagnostic imaging. But selling these solutions isn’t just about having the best tech—it’s about knowing where to sell it. Construction analytics give medical software firms a strategic edge by revealing where new healthcare facilities are being built, who’s building them, and what kind of software they’ll likely need.

What Types of Medical Software Are in Demand?

The U.S. healthcare IT software market size was estimated to be $166.83 billion in 2024. Healthcare facilities rely on a wide range of software systems to operate efficiently and deliver quality care. Some of the most common types include:

- Electronic Health Records (EHR): Centralized patient data management

- Medical Billing Software: Streamlines insurance claims and payments

- Imaging & Diagnostic Software: Powers MRI, CT, and X-ray systems

- Practice Management Software: Handles scheduling, staff coordination, and patient flow

- Pharmacy & Medication Management: Tracks prescriptions and prevents errors

- Hospital Management Systems: Manages bed allocation, billing, and staff logistics

- Telehealth Platforms: Enables remote consultations and monitoring

- Medical Research Software: Supports clinical trials and data analysis

Each software type aligns with specific facility needs—urgent care centers may prioritize billing and scheduling, while hospitals require robust imaging and management systems.

How Does Facility Type Influence Software Needs?

Not all healthcare facilities are created equal. Understanding the type of construction underway helps software companies tailor their outreach:

- Hospitals: Require comprehensive systems—EHR, imaging, hospital management, and pharmacy software

- Medical Offices: Focus on practice management, billing, and patient engagement tools

- Urgent Care Centers: Need fast, efficient scheduling and billing systems

- Operating Rooms: Depend on advanced imaging, diagnostics, and surgical coordination platforms

By filtering construction data by facility type, software firms can match their offerings to the specific operational needs of each development.

How Can Construction Pipelines Guide Market Strategy?

Construction analytics reveal not only what’s being built now, but what’s planned for the future. By analyzing medical construction pipelines, software companies can:

- Target regions with high growth in healthcare infrastructure

- Shift focus away from shrinking or saturated markets

- Forecast demand for specific software types based on facility trends

This proactive approach helps firms allocate sales resources more effectively and stay ahead of competitors.

How Can ConstructionWire Analytics Help?

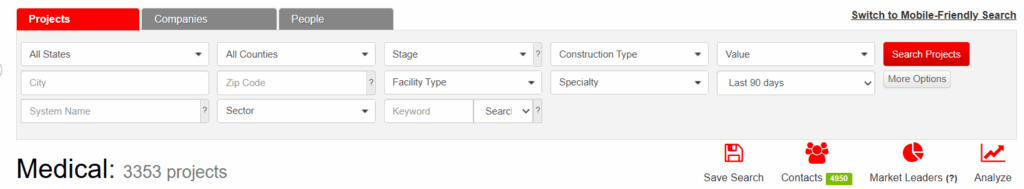

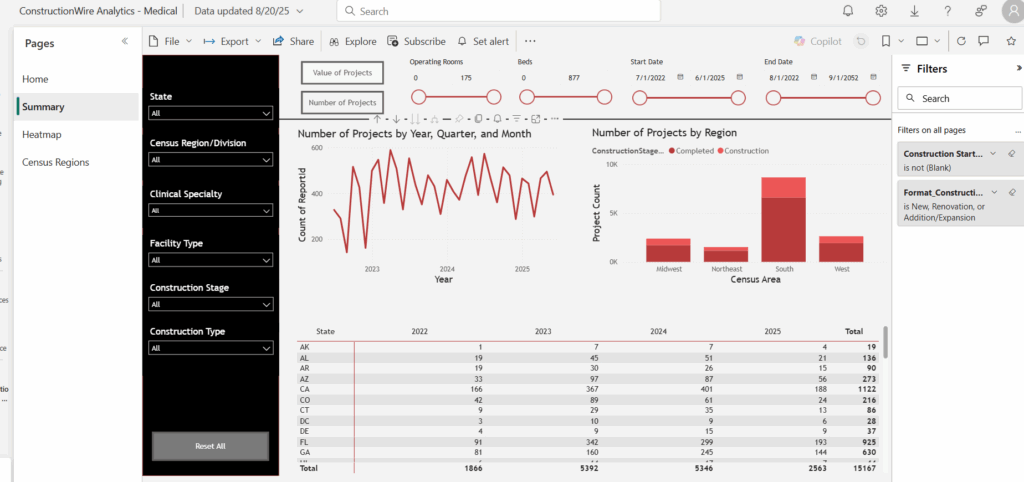

ConstructionWire Analytics is a powerful resource for medical software companies. It offers detailed insights into healthcare construction projects—segmented by facility type, location, value, and timeline. Users can track project starts, monitor pipelines, and identify the firms behind each development before construction begins.

With customizable dashboards and deep insights, ConstructionWire helps software companies stay informed, act quickly, and sell smarter. In a competitive market, data isn’t just helpful—it’s essential.

Grow your sales with construction analytics here.

Related

Top Medical Office Building Types in Development

Building Green, Earning Green: How Sustainable Construction Pays Off

There’s a Childcare Desert Problem in Rural America and Developers Have the Solution

What Does Building Green Mean in Construction, and How Can It Save You Money?